August 2, 2012 by Geoff Considine

Financial theory suggests that risk and return go hand-in-hand:

Small company stocks tend to be riskier and outperform large company stocks. Long-term bonds tend to be riskier and outperform short-term bonds. Corporate bonds tend to be riskier than Treasury bonds (with comparable terms) and outperform Treasuries over time.

However, there is one group of stocks that has consistently defied this risk/return relationship: Low-beta stocks. A low-beta strategy involves selecting stocks that have a lower-than-average beta value. (Beta is a measure of the stocks? volatility and adding low-beta stocks to your portfolio can help investors build a diversified portfolio.) The good news for investors here is that using a low-beta strategy does not require exotic financial instruments or stock picking acumen.

The Research

Low-risk stocks have historically outperformed high-risk stocks and the broader market.

The success of this approach has been proven over 40-plus years and is referred to as the ?Greatest Anomaly in Finance? by well-regarded academics in finance: Harvard Business School professor Malcom Baker, Jeffrey Wurgler of NYU-Stern School of Business. Over a 41-year period, selecting stocks with the lowest value of beta (a statistical measure of risk) from the largest 1,000 listed firms resulted in out-performance of almost 3.5% per year vs. the stock market as a whole.

Performance: Behind the Numbers

While there has been research identifying low beta portfolios as outperformers for many years only recently have there been funds that are explicitly focused on low-beta securities. (Why mutual funds have not been designed to target this strategy previously is still an unanswered question.)? Folio Investing has maintained its own low beta Folio since 2000.

Russell Investments introduced its low-beta funds in May 2011, launching the Russell 1000 Low Beta ETF (LBTA) as its large-cap low-beta fund.? Folio launched its Conservative Folio, with the explicit mandate of investing in low-beta stocks, in April 2000.? Over the past twelve months, the Conservative Folio has returned 9.2%, while LBTA has returned 12.6%.? The S&P 500 has returned 9.1% over this same period.

Since inception more than twelve years ago, the Conservative Folio has returned an annualized 8.9% per year (model returns from April 2000 to August 2009 and funded returns thereafter) vs. 1.1% annualized return for the S&P 500 (including reinvested dividends) over this same period.? The annualized volatility (a standard measure of risk) for the Conservative Folio is 18.9% per year vs. 21.7% for the S&P 500 over the period from April 2000 (when the Folio was launched) through July of 2012.

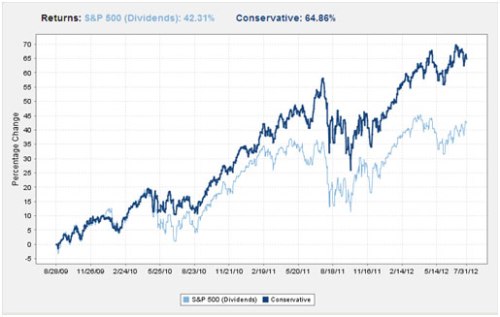

The Conservative Folio has been substantially less volatile than the S&P 500?and delivered higher returns.? The chart below shows the since-inception performance for an account invested wholly in the Conservative Folio (which Folio Investing funded with its own money) in late August 2009.

The Holdings in the Conservative Folio

The Conservative Folio was created for investors seeking a lower-level of risk than the overall market. The current holdings of the Folio are listed below:

| Company | Symbol |

| Alexion Pharmaceuticals, Inc. | ALXN |

| American Tower Corporation | AMT |

| Altisource Portfolio Solutions S.A. | ASPS |

| Activision Blizzard, Inc. | ATVI |

| Progressive Waste Solutions Ltd. | BIN |

| Ball Corporation | BLL |

| BMC Software Inc. | BMC |

| Credit Acceptance Corp. | CACC |

| CH Robinson Worldwide Inc. | CHRW |

| Catalyst Health Solutions | CHSI |

| Colgate-Palmolive Co. | CL |

| Catamaran Corporation | CTRX |

| Dollar Tree, Inc. | DLTR |

| DeVry, Inc. | DV |

| Enbridge Inc. | ENB |

| Enterprise Product Partners L.P. | EPD |

| Family Dollar Stores Inc. | FDO |

| Randgold Resources Limited | GOLD |

| The Hershey Company | HSY |

| International Business Machines Corporation | IBM |

| ITC Holdings Corp. | ITC |

| Magellan Midstream Partners LP | MMP |

| Questcor Pharmaceuticals, Inc. | QCOR |

| Royal Gold, Inc. | RGLD |

| Rollins Inc. | ROL |

| Silgan Holdings Inc. | SLGN |

| Southwestern Energy Co. | SWN |

| The TJX Companies, Inc. | TJX |

| Team Health Holdings, Inc. | TMH |

| Tyler Technologies, Inc. | TYL |

[Note: The holdings are re-evaluated and updated (as needed) on a quarterly basis.]

Commentary: A Real-World Test of Low-Beta Strategies

We believe the Conservative Folio is the longest-running real-world validation of the outperformance of low-beta stocks. With its impressive twelve-year track record, the Folio has substantially outperformed the S&P 500?admittedly no great achievement given the last decade or so?however, the annualized return of the Folio?s 8.9% return over the past twelve years is worthy of attention, especially in light of research that documents the effectiveness of low-beta investing.

As with all successful investing strategies, there is no unequivocal explanation for why the strategy has outperformed, and of course we can?t predict that this strategy will continue to outperform in the future. However, the research regarding the outperformance of low-beta investing strategies is compelling and low beta stocks tend to be focused in industries that can weather market turbulence.

To learn more about the Conservative Folio?s methodology, visit Folio Investing.

Related Links

![]()

Folio Investing The brokerage with a better way. Securities products and services offered through FOLIOfn Investments, Inc. Member FINRA/SIPC.

Like this:

Be the first to like this.

Source: http://portfolioist.com/2012/08/02/sector-watch-low-beta-stocks-3/

occupy congress juan williams victor martinez alcatraz cruise ship martin luther king jr. zappos

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.